Descubre las marcas de nuestras dos unidades de negocio: Adhesive Technologies y Consumer Brands.

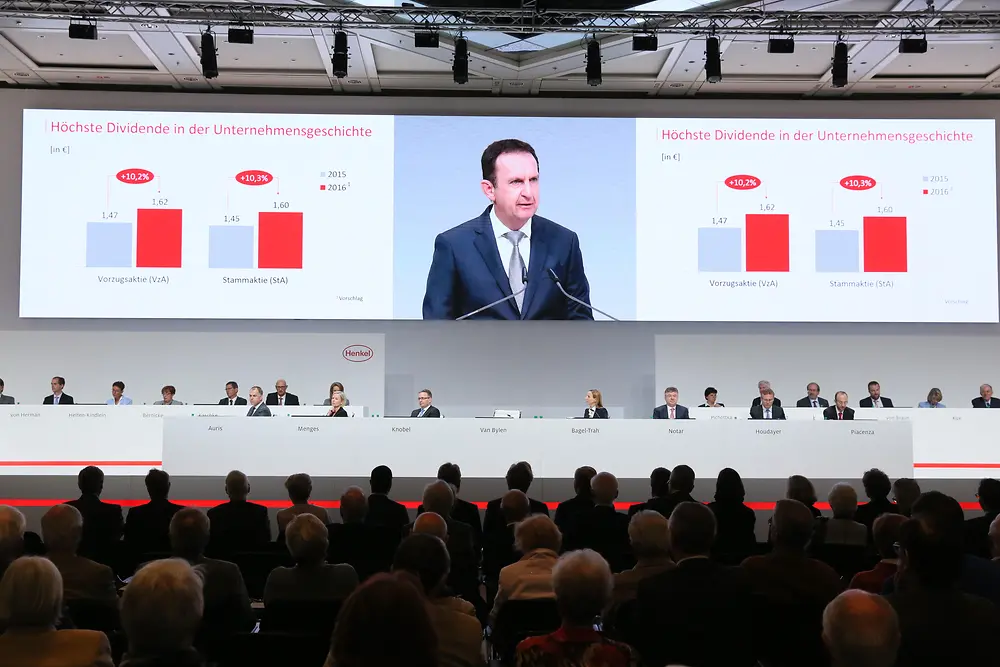

8 abr. 2019 Düsseldorf / Germany

Henkel is paying out a record dividend

Henkel AG & Co. KGaA’s Annual General Meeting saw all resolutions on its agenda passed by the voting shareholders. A total of around 1,400 shareholders attended the event, which was held in Düsseldorf on April 8, 2019.

As proposed by the corporate bodies, the Annual General Meeting approved a 3.4 percent higher dividend per preferred share of 1.85 euros (previous year: 1.79 euros) and a 3.4 percent increased dividend per ordinary share of 1.83 euros (previous year: 1.77 euros). For both share classes this is the highest dividend ever paid by Henkel. The dividend payout ratio amounts to 30.9 percent of net income after non-controlling interests and adjusted for exceptional items. The total dividend payout amounts to 805 million euros.

Since 2012, Henkel has distributed nearly 4 billion euros in dividends to its shareholders. In the same period, the dividend per preference share almost doubled from 0.95 euros to 1.85 euros. Henkel will continue to focus on offering attractive returns to its for shareholders. Therefore, the company has increased the target range for the dividend payout ratio to 30 to 40 percent of adjusted net income after non-controlling interests from fiscal year 2019 (current range: 25 to 35 percent).

This information contains forward-looking statements which are based on current estimates and assumptions made by the corporate management of Henkel AG & Co. KGaA. Statements with respect to the future are characterized by the use of words such as “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, and similar terms. Such statements are not to be understood as in any way guaranteeing that those expectations will turn out to be accurate. Future performance and results actually achieved by Henkel AG & Co. KGaA and its affiliated companies depend on a number of risks and uncertainties and may therefore differ materially from the forward-looking statements. Many of these factors are outside Henkel’s control and cannot be accurately estimated in advance, such as the future economic environment and the actions of competitors and others involved in the marketplace. Henkel neither plans nor undertakes to update any forward-looking statements.

This document includes – in the applicable financial reporting framework not clearly defined – supplemental financial measures that are or may be alternative performance measures (non-GAAP-measures). These supplemental financial measures should not be viewed in isolation or as alternatives to measures of Henkel’s net assets and financial positions or results of operations as presented in accordance with the applicable financial reporting framework in its Consolidated Financial Statements. Other companies that report or describe similarly titled alternative performance measures may calculate them differently.

This document has been issued for information purposes only and is not intended to constitute an investment advice or an offer to sell, or a solicitation of an offer to buy, any securities.